What to Do When Personal Injury Talks Are Stalled

When you’re in an accident, the insurance company is supposed to work with you to settle your claim fairly. Too often, insurance companies try to stall the case in hopes of getting away with paying you far less than you deserve.

By understanding what tactics insurance companies use to stall negotiation talks, you can identify when this is happening to you and work with your Las Vegas personal injury law firm to continue progress on your settlement discussion.

START YOUR FREE CONSULTATION

NO FEES UNLESS WE WIN!

Why Do Insurance Adjusters Delay?

An insurance adjuster may have a number of different motivations for stalling the case:

Company Policy

It may be the policy of the insurance company to deny claims routinely. The insurance company may try to maximize profits by stalling many of the claims against them.

Discouraging Victims

The insurance company might stall the case in hopes that you’ll give up. They might use delays to intimidate you. They might also stall in hopes that you’ll become tired of waiting and settle for a low amount.

Destruction of Evidence

Over time, evidence may disappear. Witnesses may move away or lose their memories. Documents may be archived or misplaced. Some insurance companies stall in hopes that you’ll lose evidence that’s valuable to the case.

Related: 7 Tips for Preserving Evidence in Your Personal Injury Case

Personal Motivation

Some insurance adjusters believe that the way to make a name for themselves is to deny legitimate claims. They might think it’s the way to get ahead even if it goes against their company’s values.

Time Delays and the Statute of Limitations

If the case stalls long enough, you may lose the opportunity to initiate formal proceedings. The name for the time limit to bring a case is called the statute of limitations. The insurance company might hope that you don’t know the rules and miss the deadline.

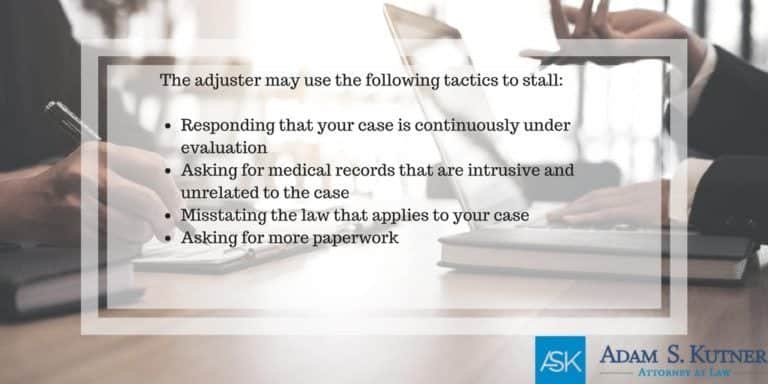

How Do They Delay?

Your insurance adjuster may try to delay your case using any of the following techniques:

- Asking for more paperwork

- Telling you that a final decision is stalled with supervisors

- Responding that your case is continuously under evaluation

- Asking for medical records that are intrusive and unrelated to the case

- Demanding additional statements from you

- Threatening you that further medical treatment isn’t going to be covered

- Misstating the law that applies to your case

What Can I Do If My Insurance Adjuster Is Stalling?

If the insurance company stalls, there are things that you can do to fight back. Here’s what you can do if the insurance company doesn’t want to negotiate your claim honestly :

Persistence

Continue to contact your insurance adjuster. Make frequent phone calls and send emails. Ask what progress they’re making on the case. Ask for specifics.

For example, if they tell you that a supervisor is reviewing the case, ask them when you can expect an answer. If they say they’re going to send an offer, ask when you can expect to receive it. If you ask for updates about the case, the insurance company might decide that it’s best to offer to pay you fairly to resolve the case.

Write a Formal Demand Letter

One way to show the insurance company that you’re serious is by writing a formal demand letter. A demand letter is a document that states what you believe is an appropriate settlement and the basis for your valuation of the case.

You can also indicate that you may bring the case to court or formal arbitration proceedings if you don’t receive the settlement you’re looking for.

Escalate

If your insurance adjuster doesn’t help you, ask to speak to their supervisor. Repeat your requests to the supervisor. If they refuse to put you in contact with a supervisor, find a general phone number for the insurance company and try again.

When more people look at the case, the chances are higher that someone is going to agree to offer a fair settlement.

Mention Bad Faith

An insurance policy is a contract. That means the insurance company has a duty to pay quickly and honestly when there’s a claim that falls under the policy’s terms.

If a jury agrees that the insurance company didn’t work with you to honestly value and pay your claim, they may find that the insurance company acted in bad faith. In that case, the insurance company may owe you legal fees in addition to owing you the value of your claim.

Bring a Lawsuit or Initiate Arbitration Proceedings

To fight the insurance company, you may need to take your case to court or through arbitration proceedings. Whether your case goes to court or arbitration depends on the terms of your policy. However, one way to nudge the insurance company to work with you is to state your willingness to go to formal proceedings.

It’s also important to be willing to follow through on filing formal proceedings. Even if you bring an official legal action, very few cases end up going to trial, so don’t worry about that yet. When you’re working with an insurance company that’s stalling your claim, it’s crucial that they believe you’re willing to take the case as far as necessary to get justice.

How Does an Attorney Help When Settlement Talks Are Stalled?

A qualified injury attorney can help you negotiate with the insurance company when you’re facing delay tactics. They can use their expertise to create a plan for when and how to contact the insurance company.

In fact, they can handle those negotiations directly so that you don’t have to worry about what to say. They have experience drafting a demand letter, and they know when it’s time to begin formal proceedings on your personal injury case. Your attorney has likely experienced stalled negotiation talks and isn’t intimidated by the insurance company’s tactics.

Legal Disclaimer

This webpage is not intended to be an advertisement or solicitation. The hiring of a lawyer is an important decision that should not be based solely upon advertisements. Material contained in our website is for general information only and does not constitute legal advice or solicitation of legal services.

Transmission of information from this site is not intended to create, and its receipt does not constitute, an attorney-client relationship between Adam S. Kutner and the user of this site. In the event that any information on this web site does not conform fully with regulations in any jurisdiction, this law firm will not accept representation based on that information.

Adam S. Kutner

PERSONAL INJURY LAWYER

With more than 34 years of experience fighting for victims of personal injury in the Las Vegas Valley, attorney Adam S. Kutner knows his way around the Nevada court system and how to get clients their settlement promptly and trouble-free.

Call (702) 382-0000 For a Free Consultation

Adam S. Kutner is a top 100 trial lawyer with 34 years’ experience and expertise that will benefit you

Call us at (702) 382-0000 anytime to schedule a free consultation. We will work to get you the maximum settlement as quickly as possible so you can move forward on your healing journey.

Adam S. Kutner reviews and testimonials

“I needed an attorney because I couldn’t deal with the accident on my own, so I needed someone else’s opinion about my accident.

Well I heard about Adam Kutner through an associate of mine and I chose to seek him because I heard of him before also, so I thought he would be the best option for me.

I was very happy with my settlement and it came quicker than I thought, in just a couple months I received a check in the mail.

When I recommend Adam Kutner I would tell them that the settlement comes very quickly, and he is very helpful with transportation and whatever else you may need.”

– Deborah Banks. 5/5 Stars